Home / News/ / Lithium cathode material sales soared! Dongsheng Technology's Q2 revenue up over 200% year-over-year

Home / News/ / Lithium cathode material sales soared! Dongsheng Technology's Q2 revenue up over 200% year-over-year

Release Time: 2022.08.30

Release Time: 2022.08.30

Views:372times

Views:372times

In the first half of this year, the market value of $ 40 billion lithium cathode materials giant Dansheng Technology sales increased significantly, revenue increased more than twice, but by the impact of raw material prices and other factors, gross margin fell slightly year-on-year.

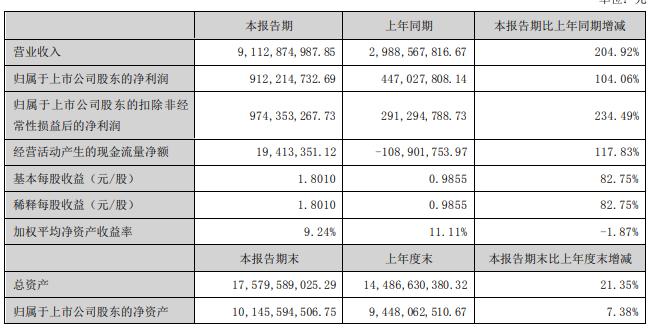

On August 29, Dang Sheng Technology announced its first half of 2022 performance report. The results show that during the reporting period, the company achieved operating revenue of 9.113 billion yuan, an increase of 204.92%; net profit attributable to shareholders of the listed company of 912 million yuan, an increase of 104.06%; net profit attributable to shareholders of the listed company after deducting non-recurring gains and losses of 974 million yuan, an increase of 234.49%; basic earnings per share of 1.8 yuan, an increase of 82.75%. Basic earnings per share were NT$1.8, an increase of 82.75%.

In the second quarter alone, the company's main revenue was RMB 5.271 billion, up 205.6% year-on-year; net profit attributable to shareholders of the listed company was RMB 525 million, up 76.35% year-on-year; net profit attributable to shareholders of the listed company was RMB 623 million, up 253.24% year-on-year; gross profit margin in the second quarter was 17.75%, down 4.8 percentage points year-on-year and up 0.3 percentage points year-on-year. The gross profit margin for the second quarter was 17.75%, down nearly 4.8 percentage points year-on-year and up 0.3 percentage points sequentially.

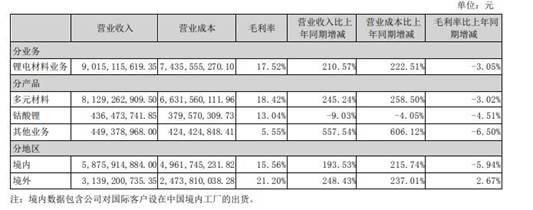

The company said that the significant growth in revenue in the first half of the year was mainly due to the significant growth in sales of lithium cathode materials and the rise in raw material prices, resulting in significant year-on-year growth in revenue. The company's product sales in the first half of the year hit a record high, of which high nickel product shipments increased significantly, accounting for an increasing proportion.

In the international market, the company has established strong cooperative relationships with global first-tier brands of power battery companies such as SK on, AESC, LG New Energy, Murata, etc., and has achieved large volume shipments of products, with international customers accounting for over 70% of sales.

In the first half of the year, the company invested 506 million yuan in R&D, an increase of 255.96% year-on-year.

The company said, the company's new generation battery materials products from solid lithium cathode materials to sodium battery materials, comprehensive coverage of new material products, new technology systems, new battery routes, the company will accelerate the transformation of related technology achievements and industrialization applications, to lay a solid foundation for the company to seize the next generation of battery materials technology and market heights in the future.

During the reporting period, the Company successfully developed ultra-high nickel cobalt-free materials and successfully solved the problems of ultra-high nickel cathode materials in terms of capacity, multiplier, cycle and safety, etc. The technical performance indexes have been greatly improved and highly recognized by domestic and foreign customers.

In addition, the financial report shows that the number of shareholders as of June 30, 2022 was 32,800, a decrease of 5,691 or 14.79% from the previous period (March 31, 2022).

As of the close of business on August 29, 2022, Dang Sheng Technology closed at RMB 83.16, down 0.4%, with a market capitalization of over RMB 42 billion.